Once a home is secured for purchase, the lender requires title insurance, which must be secured before the transaction closes. When selecting a title insurance company, you will be given the option of which coverages to choose.

A closing protection letter is one of these, which a title insurance company will provide to the lender, buyer, and seller.

What is it? And is it necessary?

A closing protection letter (CPL) is issued by the title underwriter. This document ensures that the underwriter will protect its client from any mistakes made by the title agent who handles the escrow accounts associated with the transaction.

The title agent is responsible for handling large sums of the lender’s and buyer’s money, and mistakes can be made. For example, a mistake could be if the agent misplaces or mispurposes the funds in your escrow account. There is also the risk of an agent being dishonest or fraudulent.

In any case, where a mistake is made on behalf of the agent, the closing protection letter is drawn up so that the title underwriter will protect a specific party to suffer no actual loss.

Put simply, a closing protection letter is a form of insurance intended to provide coverage to specific parties of the transaction. Each party will decide whether or not it is necessary. However, a lender will rarely hire a title agent without the issuance of a CPL, and the burden of the fee is typically placed on the buyer.

It is natural to feel a little uneasy about an insurance company handing you a document intended to protect you from them, but charge you for that document. But keep in mind that this is something they are legally required to do.

Also, not all accounts where these documents are put into effect are fraud or dishonesty. Human error does occur, and without this document, an honest mistake can cost you thousands of dollars.

What should the closing protection letter include?

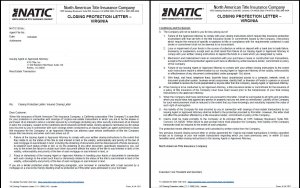

All CPLs are transaction-specific and what they offer coverage for depends on the insurance being issues. However, there shouldn’t be much deviation from one contract to the next. Please, reference the image below for an indication of what a CPL should look like.

At the very least, this document should include the name of the title insurance company, the name and address of the party it protects, and the title agent’s name, ID number, and address. From there, it should provide a clear message detailing how the title insurance company will protect the party of concern. The rest of the document should include details on the conditions and exclusions and when this protection will be provided.

This is not a complicated document, and it should not span for more than a few pages. However, the title insurance company does decide the conditions and exclusions of their coverage. It’s essential to read over the details to ensure that they are offering you proper coverage.

Should I get a closing protection letter?

You should always consider a CPL—it’s a contract that protects your money. The letter will only offer coverage to who is included explicitly in the document, though. If a lender requires a closing protection letter, remember that it will only protect them in the transaction unless expressly stated otherwise. A title underwriter may offer a closing protection letter that combines protection to the buyer and lender, but it is not typical. In most cases, each party will need to obtain their own CPL to be provided protection.

How much does a closing protection letter cost?

A title insurance company may issue a closing protection letter free of charge, but this is not usually the case. How much they charge for a CPL is ultimately their decision, but the letter typically costs $25. Anyone in the transaction who opts to receive one will be responsible for an individual fee. However, it is a one-time payment, and if the transaction cancels for any reason, there will be no charge for the CPL.